EU Climate Mandates: A Growing Threat to European Aviation’s Global Edge

The European Union’s ambitious drive toward a greener future is creating a turbulent landscape for its major airlines. New regulations, designed to mandate a gradual increase in the use of expensive Sustainable Aviation Fuel (SAF), are sparking fears that European carriers may soon be priced out of the critical Asia-bound market. According to Benjamin Smith, CEO of Air France-KLM, these policies are creating a “permanent market imbalance” that puts the continent’s aviation industry at a severe disadvantage compared to global rivals.

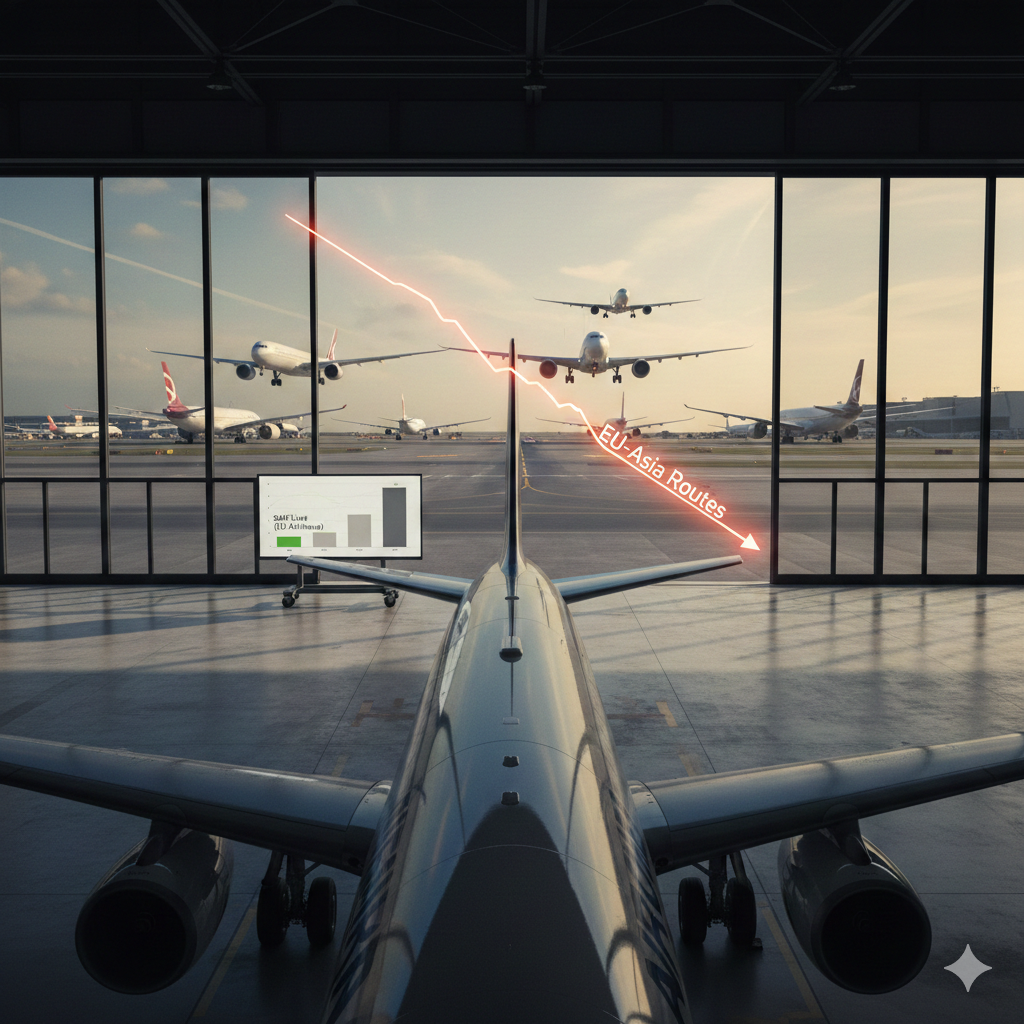

Under the current EU roadmap, airlines must ensure that 2% of their fuel uplift is SAF by January 1, 2025. This requirement is set to climb to 6% by 2030 and reach a staggering 20% by 2035. While the environmental goal of reducing carbon emissions is clear, the economic reality is daunting. SAF is currently far more expensive than traditional jet fuel, and Air France-KLM warns that without a shift in policy, 8 of its 13 current Asian routes will become unprofitable within the next decade. This could force the group to scrap nearly half of its flights to the region.

The primary concern for industry giants like Lufthansa and British Airways is that these rules do not apply to their biggest competitors. Carriers such as Emirates, Qatar Airways, and Turkish Airlines—operating through major hubs in Dubai, Doha, and Istanbul—are not bound by the EU’s strict financial SAF obligations. As a result, they can offer much more competitive pricing for passengers traveling between Europe and Asia. This cost gap has already seen Air France-KLM retreat from five Asian routes since 2015, unable to sustain the price war against Gulf-based carriers.

While the EU remains committed to its climate targets, airline executives and industry experts argue that ecological ambition should not come at the cost of economic suicide. The fear is that as European airlines reduce their services to maintain profitability, they are effectively handing over their market share to foreign competitors. Without a more level global playing field or significant financial support, the “green” transition may leave European aviation significantly smaller and less influential on the world stage.