According to the Largest Sovereign Wealth Fund, European markets are Lagging behind the US

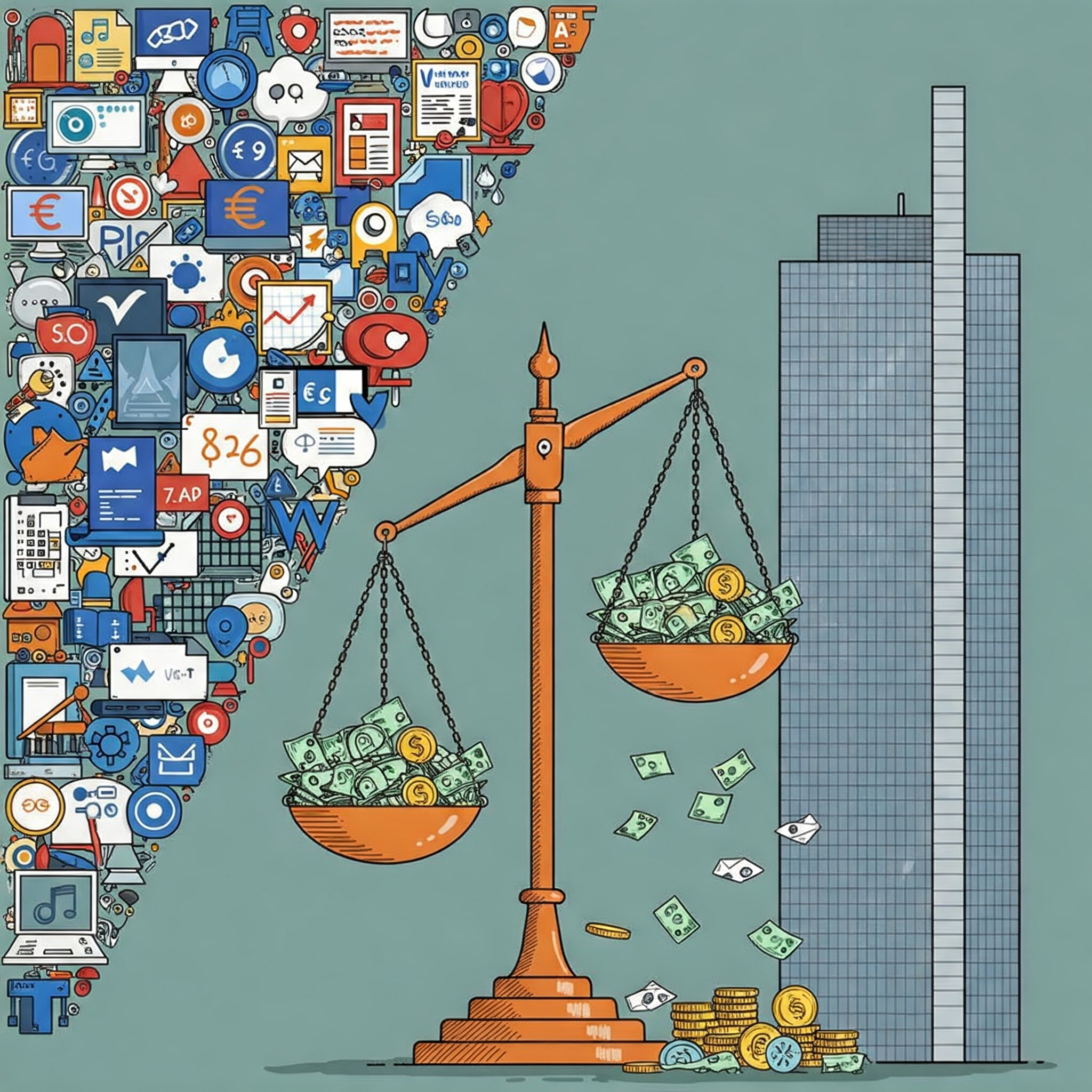

Norway’s $1.9 trillion pension fund has called for urgent reform of Europe’s capital markets. The fund will submit its official response to a European Commission consultation this week, warning that the continent could fall further behind the US and Asia in terms of competitiveness, the Financial Times reported.

Norway’s government pension fund, also known as the oil fund, owns an average of 2.5% of all listed companies in Europe, making it the largest single European asset holder. It owns SAP, ASML, Novo Nordisk, Nestle, and UBS. However, over the past decade, the share of European stocks in the Norwegian fund’s total assets has fallen from 26% to 15%. By comparison, the US share rose from 21% to 40% over the same period.

The fund identified differences in regulatory models across European countries, including national differences in securities and corporate law, as key obstacles to developing capital markets. At the same time, the liquidity of European shares needs to be improved through competition and innovation, and supervision needs to be unified at the European level.